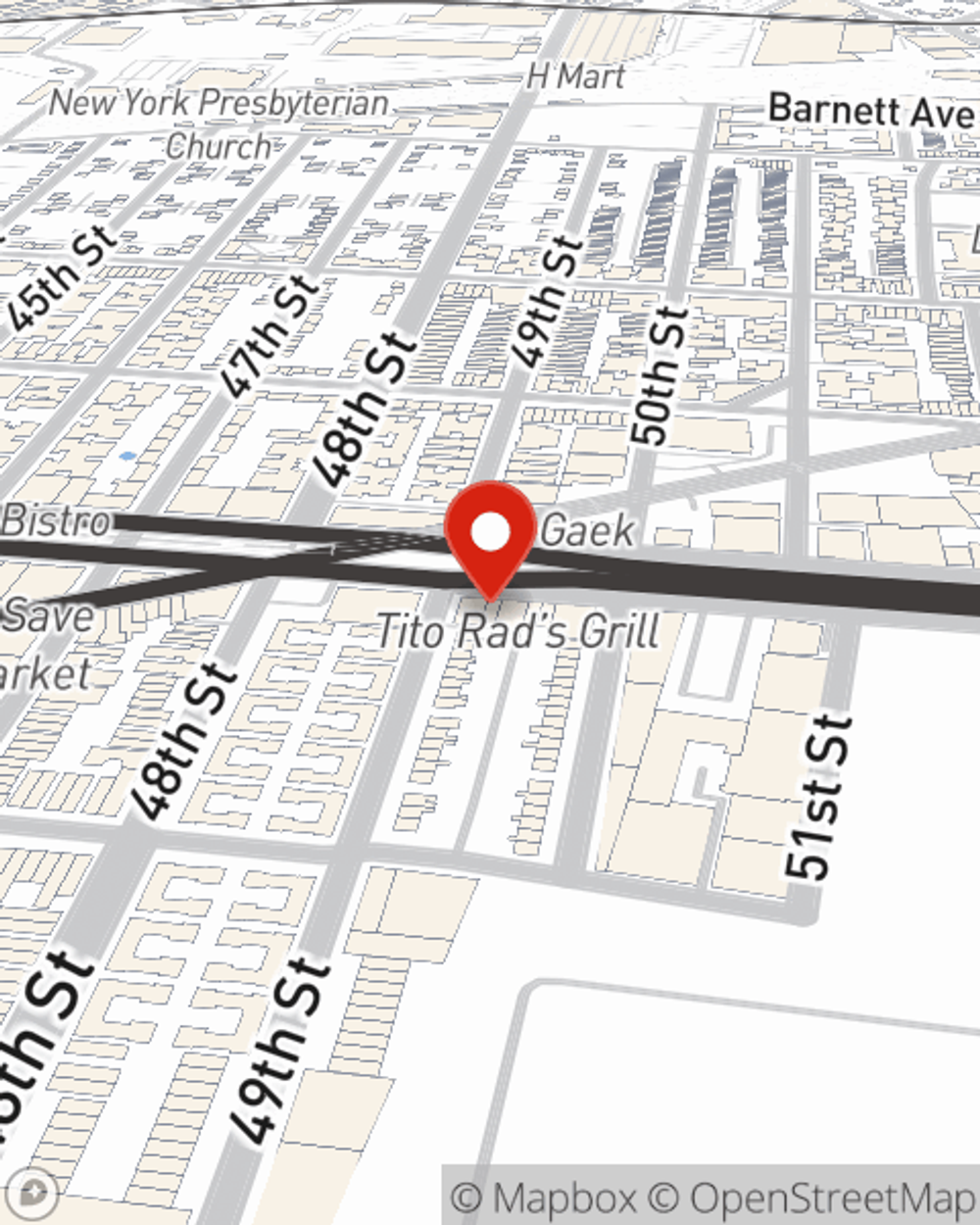

Renters Insurance in and around Woodside

Woodside renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Queens

- Bronx County

- Hudson County

- Queens County

- New York County

- Kings County

- Sunnyside

- Corona

- Jamaica

- Maspeth

- Flushing

- Glendale

- Woodside

- Ridgewood

- Woodhaven

- College Point

- East Elmhurst

- Middle Village

- Jackson Heights

- Forest Hills

- New York City

- Brooklyn

- Bronx

- Astoria

Protecting What You Own In Your Rental Home

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected accident or mishap. And you also need liability protection for friends or visitors who might stumble and fall on your property. State Farm Agent Kenny Vega is ready to help you prepare for potential mishaps with high-quality coverage for your renters insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Kenny Vega can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Woodside renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Why Renters In Woodside Choose State Farm

The unpredictable happens. Unfortunately, the stuff in your rented townhome, such as a video game system, a desk and a laptop, aren't immune to tornado or smoke damage. Your good neighbor, agent Kenny Vega, can help you examine your needs and find the right insurance options to protect your belongings from the unexpected.

It's never a bad idea to be prepared. Contact State Farm agent Kenny Vega for help getting started on coverage options for your rented home.

Have More Questions About Renters Insurance?

Call Kenny at (718) 413-0033 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.